When making the decision whether to invest in an index fund or try and trade stocks yourself you need to figure out if it’s possible to forecast stock prices.

Princeton economist Burton Malkiel wrote a book in 1973 called “A Random Walk Down Wall Street” where he proposed that stock movements are largely random and the average investor cannot outperform the major indices.

The stock market by nature is efficient. Stock prices reflect earnings, dividends, expectations and all other available data. Only new information can alter a stock’s price and by definition new information is not predictable.

This hasn’t stopped investors and analysts from trying.

Fundamental Analysis

Many investors believe that the market isn’t efficient at all and that since most investors are emotional that they can analyze the fundamentals of companies and pick winners.

Warren Buffet has been the most successful fundamental investor.

“You will notice that our major equity holdings are relatively few. We select such investments on a long-term basis, weighing the same factors as would be involved in the purchase of 100% of an operating business: (1) favorable long-term economic characteristics; (2) competent and honest management; (3) purchase price attractive when measured against the yardstick of value to a private owner; and (4) an industry with which we are familiar and whose long-term business characteristics we feel competent to judge. It is difficult to find investments meeting such a test, and that is one reason for our concentration of holdings. We simply can’t find one hundred different securities that conform to our investment requirements. However, we feel quite comfortable concentrating our holdings in the much smaller number that we do identify as attractive.”

– Warren Buffett

By analyzing a company’s accounting, financial data, the accounting and financial data or their competitors, the historical performance of management, core business concepts and strategy you can determine the true value.

It’s not enough to know if a company is undervalued or overvalued. You also need to forecast the trends within the company’s industry, trends within the national economy and the relationships between all three.

These 3 analysis points make up a “Triad of Fundamental Value”. If you think a company is undervalued and will outperform its valuation and competition in an industry that is growing in a market that is bullish then you fundamentally have a winner.

Technical Analysis

Technical analysis is based on the idea that all market forces are consolidated into the market action and past price movements of a stock and through close examination it is possible to predict future movement.

Using stock charts traders examine the market open prices, market close prices, volume, highs, lows and trends to predict how a stock will perform in the short term and the long term.

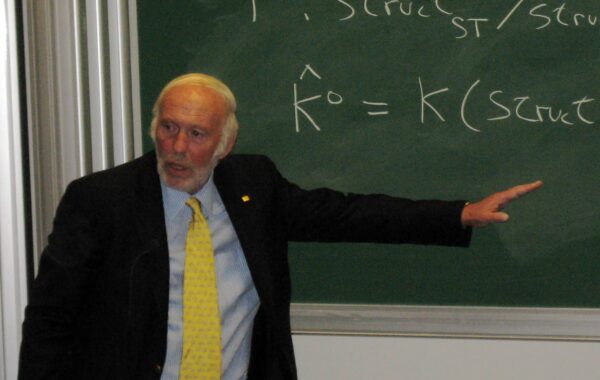

Jim Simons of Renaissance Technologies is one of the most well known technical traders. By distilling analysis down to its basis and then building up a complex quantitative analysis run by computer algorithms Renaissance has managed to decimate the market with their Medallion fund.

The idea that technical analysis works can become a self fulfilling prophecy. If every broker on Wall Street expects a stock to break out at a certain point then they’re all going to invest right before it does, and that market pressure will become a self realization.

“We have three criteria: If it’s publicly traded, liquid and amenable to modeling, we trade it.”

– Jim Simons

Technical analysis can consider thousands of variables, and it’s easy to get lost in the noise especially if you can’t focus entirely on the matter at hand.

If you plan on doing trades based on technical analysis you should immerse yourself in the data. Set up a quiet isolated space with a computer and 2 monitors and go as deep and wide as possible.

Start with facts before you start making predictions. What is the historical trend of the stock and the industry? What is the current trend? Is the stock behaving predictably according to your models? At what times has the stock behaved erratically? What caused those anomalous behaviors?

Large hedge funds account for a large number of variables with computer algorithms. As an individual trader that probably doesn’t know how to write computer code you will need to develop your own system for analysis. The real trick is to distill complexity and variability into a simple exercise. I personally do this by first qualifying a stock and trading period with a set criteria and then applying a simple analysis.

Is It Possible to Forecast Stock Prices?

The short answer is no. There are far too many variables to reliably predict future price movement. It would be extremely foolhardy and presumptuous to believe that with thousands of brokers and analysts devoting 16 hour days to the market that you know better than all of them. After all, the price is dictated by the market and those analysts are the driving force behind it.

However, if you learn to read stock charts and stay on top of news headlines that could affect your positions, you can make educated guesses about how other analysts will react. Now you just have to react faster than the next guy.

Financial institutions invest millions every year to make their hardware, software and infrastructure faster at executing trades once they’ve been pegged.

You have two solid options for attempting to beat the market. First is to use technical analysis to make bets on the most predictable cycles of stock movement. The 2,478% gains put up by Renaissance Technologies Medallion Fund in the 1990s are a testament to the possibilities available to gifted traders that excel at math and remain disciplined.

The second option is to identify the underlying value of companies and base long term investments on fundamental analysis. The longer timeframe can actually make this strategy riskier than shorter holds based on purely technical analysis.

If you invested $1,000 in Berkshire Hathaway stock in November 1980 it would be worth a staggering $712,500 today. By diversifying the company’s investments and concentrating on investments that he believed he could quickly turn into winners, Warren Buffet has attained monstrous growth with a relatively low risk strategy.

Which Investment Strategy is Better?

Jim Simons would say you can predict future movements of stock prices to an extent, and Warren Buffet would say that you can count on the market to adjust its valuation of a company when its outlook has been improved. You can win using both methods.

The one thing you can say for sure is that Jim Simons would not have been as successful as a fundamentals guy and Warren Buffet would not have been as successful as a highly technical day trader. Each man has talents and experience that made them specially suited to their chosen strategy. Odds are that you too have talents that would make you better suited for one style of investing over the other.

Different approaches can also be used to address your specific psychology and risk tolerance.

After all you don’t have to forecast future stock prices with pinpoint accuracy, you only have to guess that a stock will trade for more tomorrow than it does today.

If your investments are a successful at a certain point you will employ both strategies. Long term value investments can serve as a safe vehicle for short term gains from technical analysis. You can see this happening in the Cryptocurrency markets when investors take profit from alt coin investments and move it to larger cap coins like Bitcoin and Ethereum.

The Third Option: Passive Investing

If you fully subscribe to the random walk theory there is a third option that has gained popularity over the last 2 decades: passive investing.

Passive investors devise a strategy to continually contribute to a mixture of exchange traded funds and other assets that diversify the investment into a number of underlying assets.

The development of fee free trading with Robin Hood and the popularity of passive investing has fueled the rise of popular tech stocks like Amazon and Facebook while stunting value stocks. People are quick to say it is creating a bubble or sorts; but nothing is quite as sustainable as many people making small investments over time.

If most mutual funds do not beat the market average then you can temper risk and enjoy moderate growth with a disciplined passive investment strategy.

No matter if you choose technical analysis, fundamental analysis or a passive investment strategy the main thing is to invest early and often. You will always lose if you never play the game and most investors come out ahead over time no matter which strategy they chose.

- Bitcoin’s Lightning Network Explained - July 24, 2023

- What is Signature Aggregation? - October 5, 2022

- How John Hwang Built Rainier Arms and His Diverse Personal Investment Portfolio - February 22, 2021