If you’re tired of struggling and want to improve your finances, you have to make successful investments. There are a few rules for successful investment that can help guarantee performance in the long run.

Most people learn about finance the hard way through trial and error. You can avoid a lot of losses and heartache by following these 8 rules for successful investment.

8 Rules for Successful Investment

- Buy Low Sell High

- Invest Early and Often

- Choose High Risk Investments Early On

- Diversify Your Holdings

- Personalize Your Investment Strategies

- Never Invest More Than You Are Willing To Lose

- Don’t Panic

- You Haven’t Lost or Gained Until You Sell

Buy Low, Sell High

Of all the rules for successful investment buying low and selling high is the most important. Markets always return to mean and new investors almost always miss the best opportunity to sell because they expect a rising stock to just keep going.

If a security is valued high don’t buy it. Wait until the market corrects. If the price is low you should be buying and not selling.

At some point you have to sell to actually make any money. Don’t be greedy and set stop loss orders to lock in earnings when prices soar.

Even if you plan on keeping a stock in your portfolio for decades you should still sell portions of your holdings when prices increase. If they keep rising then you locked in some profit and liquidated a percentage of an asset; if the prices fall then you can buy back and increase your holdings.

Invest Early and Often

“Compound interest is the 8th wonder of the world. He who understands it earns it. He who doesn’t pays it” – Albert Einstein

Most people do not realize the wealth that even the lower class could accumulate if they started investing at a young age. Teenagers don’t usually have a lot of money, but they have a lot of time ahead of them.

Let’s look at a hypothetical scenario to see the true power of compound interest. A young man named John had saved $500 from birthday money and cutting grass by the time of his 18th birthday. John didn’t have high self esteem so he bypassed college and went straight to work at a factory making $42,000 per year.

After paying bills and living frugally he was able to save 10% of his income which added up to $87.50 per week, or $350 per month.

John invested his initial $500 along with $350 every month in investments that brought a 6% average annual return. He worked until he was 65, and when he retired his savings amounted to $1,020,347.13.

So even if you have a low paying job you can retire a millionaire if you start investing early and stay disciplined.

Join High Risk Investments When You Are Young and Reduce Risk As You Get Older

The higher the risk, the greater the reward. If you really want to get the most out of investing you need to get involved in projects with larger upsides. Unfortunately this means that you’re more likely to lose.

The solution is to start out with higher risk investments when you are young and switch to more predictable assets over time. If you lose $5,000 when you are 21 you still have 50 years to make it back. If you lose everything when you’re 63 then you may have a hard time in retirement.

The Rule of 100

The most straightforward representation of this type of asset allocation is the ‘rule of 100’. According to the rule of 100 your age from the number 100 and the result is what percentage of your portfolio should be allocated to higher risk equities like stocks.

So if you are 25 years old you should have 75% of your savings in stocks and other higher reward investments. When you turn 70 only 30% of your investments should be in securities and the other 70% should be in fixed income assets such as real estate, treasury bills, high grade bonds and cash.

Risk Management

The rule of 100 is a conventional approach and should be used mainly to inform your personal strategy and provoke thought. Rigidly sticking to your age wouldn’t be the optimal strategy for about anyone. For example a 70 year old man that has significant assets over 1 million would not want to tie up 70% of his portfolio in bonds.

Everyone is different and the primary point is to strategize your risk management and asset allocation.

Diversify Your Investments

Diversity is the cornerstone of any good investment strategy. Not only does it hedge your portfolio against losses, it gives you more options for leveraging your assets.

One of the simplest solutions for diversifying a portfolio is to select 5 ETFs and invest equally in each. Use dollar-cost averaging by investing the same amount every month.

- A large cap growth ETF

- A small cap value ETF

- An emerging markets ETF

- A bond market ETF

- A real estate ETF.

In the long run this strategy should easily outpace most mutual funds. The diversity makes it a much more stable investment strategy than picking single stocks. You can also balance your holding each month which should lead to additional returns.

Risk Parity Model

The problem with the conventional approach to diversification is that when the market goes down it often takes many of the asset classes that are traditionally considered diversified with it.

Bridgewater Capital tried addressing this issue with their “All Weather Fund” which contains a mix of equities, treasuries, fixed income assets, and commodities that target similar returns in bull and bear markets. Ray Dalio developed the risk parity model so his estate could be invested without active management after he passed on.

The 4 Seasons of the Market

- Higher than expected inflation (rising prices).

- Lower than expected inflation (or deflation).

- Higher than expected economic growth.

- Lower than expected economic growth.

In normal market conditions analysts and investors form a consensus on expectations. It’s only when those expectations are surpassed that the market is bullish. The chances of the market over performing or underperforming are about 50/50 so it’s virtually impossible to predict.

The 2020 market crash was the ultimate test for the Risk Parity model. No one expected a global pandemic and the different asset classes performed just like economists expected. Advanced Research Investment Solutions RPAR ETF was down only 19% at the bottom of the dip from its previous high when the DOW was down 37%. When you lose less during hard times it’s much easier to recoup once the upside begins.

If you’re interested in this type of diversification I suggest going with either Bridgewater’s All Weather Fund or the RPAR ETF mentioned above. Large hedge funds can manage this type of strategy easier and will get a better all around diversification. They will also be able to react to market changes and re balance assets to optimize the strategy.

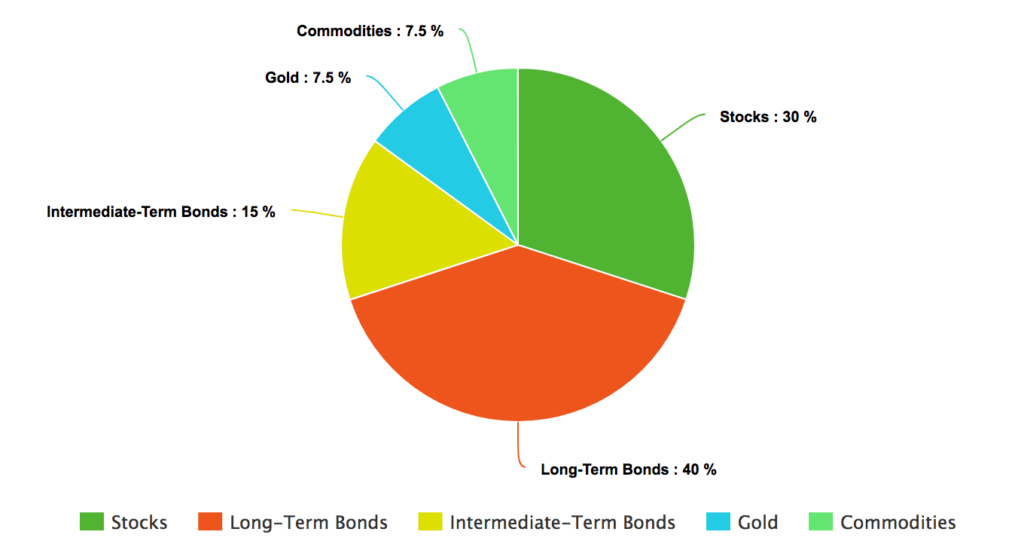

If you would like to set up your own All Weather Fund you could mirror Ray Dalio’s formula with a mix of these ETFs.

- 30% Vanguard Total Stock Market ETF (VTI)

- 40% iShares 20+ Year Treasury ETF (TLT)

- 15% iShares 7 – 10 Year Treasury ETF (IEF)

- 7.5% SPDR Gold Shares ETF (GLD) or purchase physical gold and silver

- 7.5% PowerShares DB Commodity Index Tracking Fund (DBC)

My Diversified Portfolio

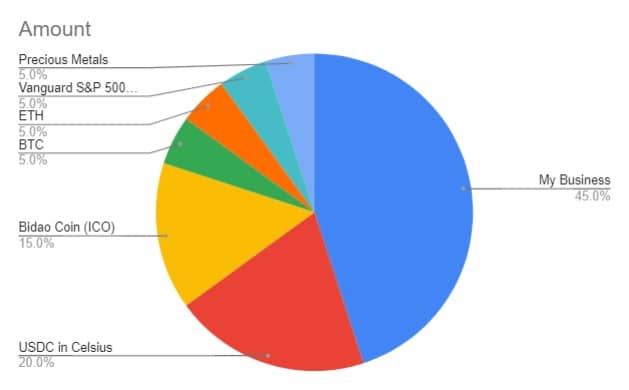

The 5 ETF and risk parity strategies are both great passive investment strategies that you can invest in without much afterthought or risk. Since I’m active in the markets and have special expertise in cryptocurrency I am currently engaged in more active management type investing, but I still diversify my holdings.

For an active management situation I believe your primary investment should be a small business or real estate, preferably with an online component. You should have a small portfolio of stocks and ETFs, and you shouldn’t overlook the Cryptocurrency market which is currently offering some incredible returns on stable coins.

I recently switched from an American Express high yield savings to investing in stable coins with the Celsius network. In just a few months the rate on my American express savings account dropped from 1.15% to 0.08%. On the Celsius network I can earn 11.5% APY.

I will share my portfolio structure to give you an idea what it looks like.

- My business currently returns about 75% per year.

- Bidao coin is a higher risk investment that I thoroughly researched and selected from a field of abut 100 options.

- My USDC in Celsius is as stable as a savings account at 10.5%.

- Bitcoin and Ethereum are volatile but have shown a great deal of support at certain price points. Over the past several months both coins have consistently moved between points of resistance and support. I have increased my BTC holdings 35% after fees. (I have Ethereum staked in a liquidity pool and will liquidate both when there is a Bull Run).

- The S&P 500 and precious metals are safe investments over long periods that have historically beat inflation.

Bitcoin and Ethereum sometimes correlate to the overall market and sometimes correlate to gold, and sometimes to neither. My USDC makes a flat 10.5% in any market and my business has performed well across market conditions.

I have started to move some of this allocation to Bitcoin toward the end of 2020 (this graph and article was written in November). I will cover this more in depth in upcoming articles.

Choose Investment Strategies Based on Your Skill, Experience, and Abilities

It’s important to choose strategies that can be managed on your available time with the resources that you have at your disposal. A day trader that can spend most of their time tracking stocks can make a lot of profit making many trades everyday.

If you have a demanding job that doesn’t allow you the flexibility to track your investments then you need to strategize accordingly. Lots of new investors jump in to attractive assets that are highly volatile. They almost never get out in time when professionals decide it’s time to sell. An investment such as a rental property or a small business is not subject to the whims of other investors.

If you have spent 10 years as a construction worker then a construction business would be far safer than buying a restaurant.

Never Invest More Than You Are Willing To Lose

Several markets have evolved to chew up new investors and syphon all of their money into the pockets of day traders. Whales often manipulate stock prices with large investments. This manipulation tricks new investors into piling on an investment that is trending higher. Once an asset’s price pumps they sale which scares the new investor out of their position, but only after the whale has made a profit.

Most people quit investing because they buy an asset at a high price and exit at a loss. You need the fortitude to be able to ignore short term movement and hold investments that are still viable even if their tickers are red.

Don’t Panic

As humans we are naturally risk averse. Our experiences lead us to view paper money as something valuable. We start to measure everything else by the value of that paper. A successful investor must adopt an entirely different mindset and view their investments as something of value and paper as something you burn in a stove.

There are cycles to every market and with due diligence you can evaluate risk before you invest in anything. If you understand these things before you invest then it shouldn’t surprise you if an asset falls in value. If you have followed all of the rules of investing then having one asset’s price drop will not wreck your entire savings.

We hope that every investment makes a huge profit in a short time. Diversified positions help hedge against investments that take short term losses.

You Haven’t Gained or Lost Anything Until You Sell

The basis of investing is picking securities that you believe are worth more than their current market price and speculating on companies that you believe will be worth more tomorrow than they are today. Besides your specific investment you will also be subject to the trends of the overall market.

If you buy in a bull market that quickly turns bearish you may need to hold an investment for a couple years. If your initial appraisal was correct then you can recover the next time the market grows to the level you bought in at or more.

A Caveat to The Rules

When it comes to investing there is really only one rule; to make money. These rules have long been held true by experts and you need to know them and follow them to a degree. It’s up to you to figure what degree that is though.

In 2020 we are learning new ways to make money. The average investor has more opportunities than ever. Whether you buy Bitcoin or art, the old ways aren’t the only option anymore. Things that used to be true aren’t true anymore, and things that were once safe are now ineffective.

The best path is to keep learning and avoid letting your emotions drive your decisions. Opportunities come along everyday and you don’t want your cart tied to a donkey when a thoroughbred shows up.

If you understand the rules for successful investment and performed due diligence then you will be a winning investor. If you invest based on emotion or a random tip and do not hold fast to these rules, even luck and probability will stack against you.

- Bitcoin’s Lightning Network Explained - July 24, 2023

- What is Signature Aggregation? - October 5, 2022

- How John Hwang Built Rainier Arms and His Diverse Personal Investment Portfolio - February 22, 2021