Getting $600 is a great way to start out the new year. Wal Mart already has a 70″ TV for $599 designed to take your money. However, some people will want some ideas for investing their stimulus check instead of wasting it.

This windfall can be your first step to financial security. 2021 is a unique time period that presents its own challenges and opportunities.

Most experts believe that 2021 will offer opportunities for cryptocurrency, commodities and technology. Here are some ideas I’ve selected for their simplicity, risk to reward profile, and potential for intermediate gains for investing your stimulus check in 2021.

Buy Bitcoin

Bitcoin has been in the news constantly since December. It has crushed one all-time high after another. Most people believe that when something is at an all time high that it’s a bad time to invest.

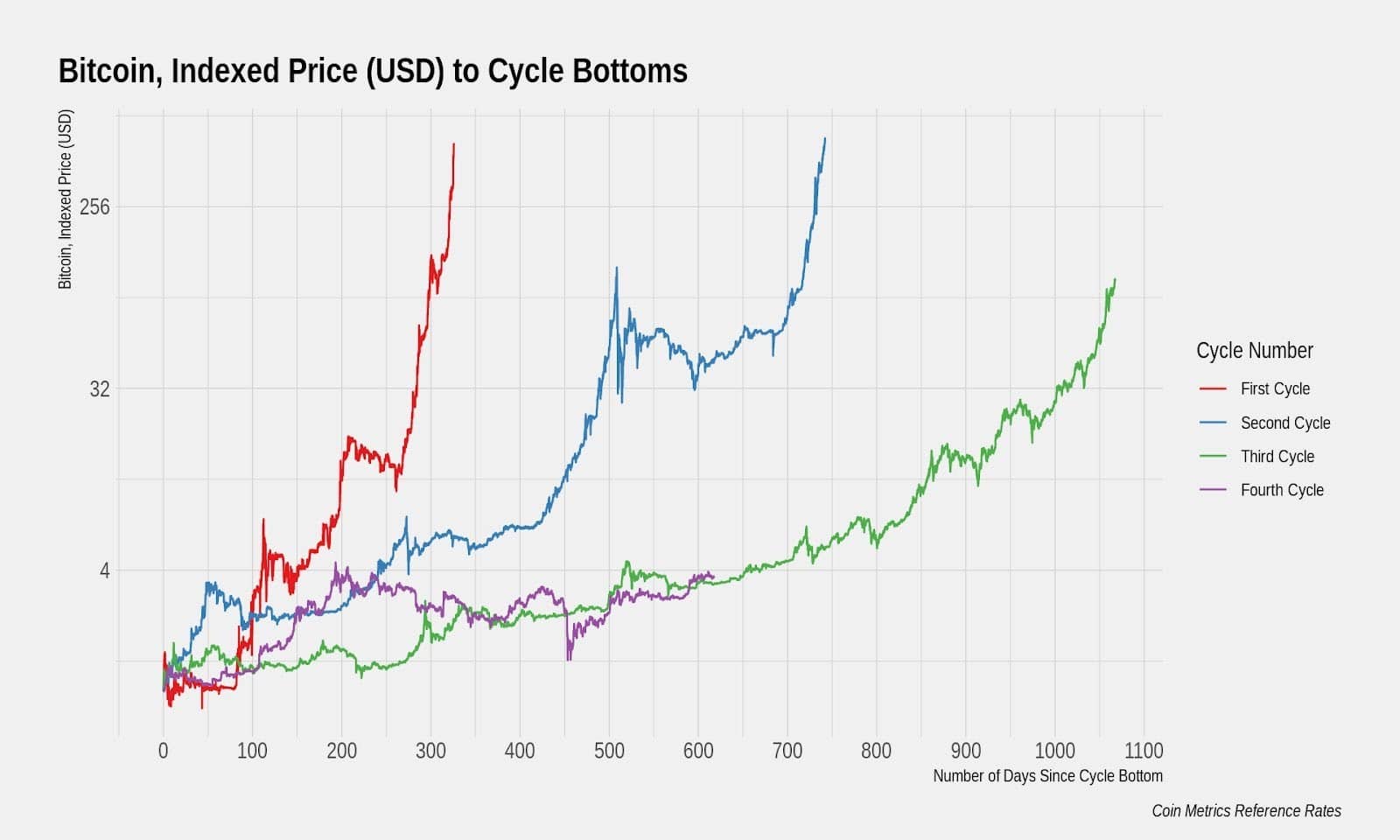

In the case of Bitcoin we are about halfway through an 18 month cycle that happens every time mining rewards halve. Almost every crypto analyst out there believes Bitcoin will surge to prices between $60,000 – $150,000.

2020 is the first year that large companies and financial powerhouses have jumped on the Bitcoin train. These large investors plan to hold Bitcoin for years through price corrections and changing political climates.

- PayPal

- Jack Dorsey, CEO of Square

- Michael Saylor, CEO of Microstrategy

- ARK Investment Management

- Michael Sonnenshein, Managing Director Grayscale Investments

This will be the 3rd halving cycle, each time seeing BTC prices skyrocket as the supply constricts spurring a buying frenzy. There are no such things as sure things, but if there ever was one it’s the 2021 Bitcoin Rally.

If you’d like to start investing in Bitcoin I suggest using Coinbase, an exchange that is user friendly and is insured. Before investing in any crypto asset I suggest becoming familiar with security measures and adopting a stringent security strategy.

Bitcoin is the investment with the shortest possible window for returns, but it is also the most volatile. Expect to sell your BTC before the end of the year for maximum return, and plan on holding a percentage of your gains or buying back in after the subsequent correction. BTC is at $30,884

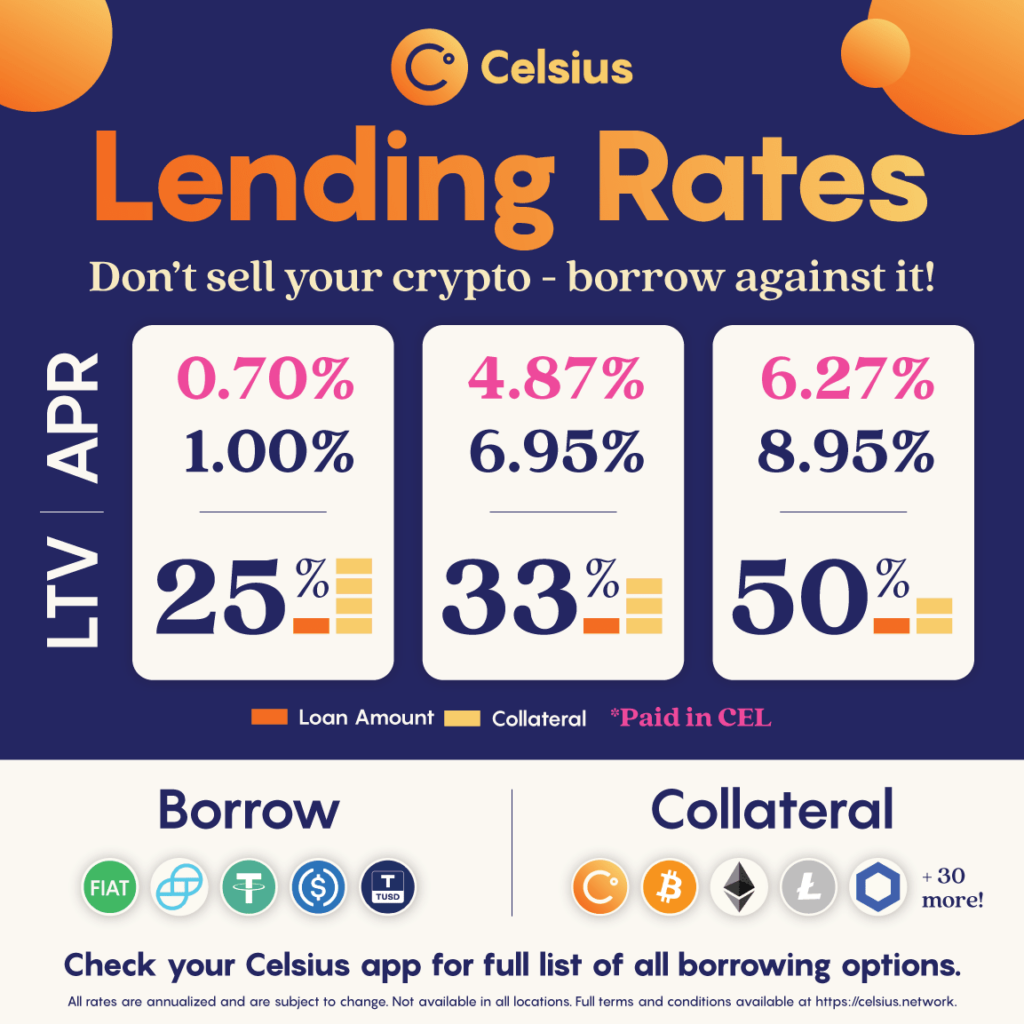

Get 10% APY From Celsius

Cryptocurrency isn’t just about investing, it’s about new financial technologies that can be used for all types of things. Celsius allows users to borrow money using their cryptocurrency as collateral.

If you have enough collateral you can take out loans with rates as low as 1%.

To supply liquidity for loans investors can deposit a number of cryptocurrencies and stable coins in a hot wallet connected to Celsius. You can remove your funds at any time.

For USDC (a stable coin backed by deposits of US Dollars) you can currently get 10.5% APY paid weekly. Since USDC is always worth $1 it is as safe as putting your dollars in a bank.

There is a 3% fee for depositing and a fee for withdrawing so if you do not plan on leaving your USDC in Celsius for at least 6-8 months don’t bother. For people that are only getting 1% on savings they have left in banks for years this could be a tremendous improvement.

If you do not hold any crypto you will need to buy it from an on ramp such as Coinbase first. Then you send it to the corresponding wallet in your Celsius account. You can buy USDC free of charge on Coinbase.

One thing to remember; if you are not familiar with how crypto wallets work you should familiarize yourself before transferring money from Coinbase to Celsius. If you transfer your crypto to a wallet on the wrong chain you can lose it forever. Always transfer Bitcoin from one Bitcoin wallet to another and USDC from one USDC wallet to another.

Hedge Risk With Advance Research’s RPAR ETF

Risk Parity is portfolio strategy where the fund is diversified into both stocks, treasuries, commodities and alternatives to allow an investment to enjoy returns in a bull market and hedge against losses in a bear market.

Since 2021 will be anything but predictable investors can use these managed ETFs to reduce their downside risk while till having exposure to stocks. It is crucial to use leverage when executing risk parity making it hard for the average investor.

The reason I like Advanced Research’s RPAR ETF is because they use commodities and gold along with treasuries to counteract risk. Since Bonds are at an all time low it is important to focus on commodities and gold if inflation rises.

You can easily invest in Advanced Research’s RPAR ETF by downloading Robin Hood and making a free trade. RPAR is $23.80

Take Advantage of Political Environment With iShares Global Clean Energy ETF

With a new President likely stepping into power in a few days and a possible Democrat majority in the Senate the beginning of 2021 is likely a good time to get invested in clean energy.

Today it was reported that electric cars sales made up 54% of the entire market in Norway. California has banned the sale of gasoline powered cars by 2035.

We are moving toward more renewable sources of clean energy and energy is a market segment that will always be in demand. The problem is that a lot of clean energy startups never become profitable and end up dying. By investing in a managed ETF we can leverage the knowledge of experts and rely on diversification to limit our risk exposure.

Even if the democrats do not gain a majority in the senate renewable clean energy will be an issue that is more easily compromised than firearm regulation. Just keep in mind that real progress in emerging technologies is a long term goal. Many of these companies will trade at extremely high P/E ratios, but overall the market will see growth similar to large tech companies over the previous 10 years.

You can invest in ICLN with your Robin Hood app. If you do not have a Robin Hood account use my referral link to get a free share of stock.

Since the timeframe of development in clean energy is so long, I would plan on taking profits along the way to secure your investment value. ICLN is $28.61

Invest in Gold & Silver

The US government has over leveraged our monetary policy in 2020. Even though experts do not agree how far we can go into debt, the more debt we issue the more susceptible we are to having an event trigger hyperinflation.

Gold prices have been artificially suppressed for decades. Governments and large financial institutions have both been accused of interfering with the price of gold.

It isn’t a question of whether Gold is a good investment, but whether you believe Bitcoin will replace gold as the world’s preferred store of reserve currency. Either way you should be investing in either gold or Bitcoin at all times.

Silver has an added benefit of massive utility. Do not let analysts overstate its utility though. Not all solar cells use silver and most producers have either moved away from silver or developed designs that use significantly less silver due to its cost.

Silver is a great way to fractionalize gold though and it always has been.

If you choose to invest in gold you should expect to hold it for several years. Buyers pay a small premium to purchase gold from dealers and receive a discounted price when they sell.

How to Invest in Gold & Silver

The best ways to invest for the average person is to purchase physical gold and silver and invest in a sturdy large safe that is anchored to the floor for storage.

If you purchase gold I prefer fractional gold bars. If you purchase silver I prefer junk silver coins and US silver eagles. Most gold bars can be verified with software now, and junk silver coins are easy to identify and verify.

When buying precious metals you need to be careful not to purchase fakes. Always buy from a trusted bullion dealer. Do not be tempted by low pricing on auction sites.

If you plan on investing large amounts in precious metals you should also invest in tools to help identify them. If you’re capable of identifying fakes the best deals can be found by purchasing gold jewelry off the street.

I prefer the Precious Metal Verifier, but it costs around $900. Budget models of similar technology can be purchased for around $300. The industry standard for testing gold is still using a stone and acid test which can be purchased for <$20. You will need to scratch the gold to test it however.

Gold is at $1,936

Which Should You Choose For Your Stimulus?

As a new investor the idea is just get started. A stimulus is a great way to kickstart your investment accounts.

When investing for retirement you should immediately start diversifying your investments. If you are just trying to make a quick buck Bitcoin is still attractive even though it’s at an all time high. Anyone who is risk averse the Celsius savings is probably the way to go.

Overall $600 is a very small investment. You should consider this a start. Plan to invest monthly in a diverse portfolio going forward. Rome wasn’t built in a day and wealth cannot be built in a short time either.

We expect that Bitcoin could fall back to the $25,000 range, Gold could fall back to $1,200, RPAR could fall to $18, and ICLN could fall back to $15. If they were to hit these marks, it might be a good idea to double your position then. This is counterintuitive to human emotion, but it’s a proven strategy to win when investing.

Diversification

If you were to purchase all 5 investments the strategy would be to take profits as the winners grow and hold onto the investments that didn’t grow over time employing dollar cost averaging to lower the cost of your investment.

Many of these investments are correlated (they were chosen to reflect analyst projections) so you’d want other assets to diversify, but if I were to invest in these 5 assets today I would split them up like this.

- Bitcoin – 35%

- ICLN – 20%

- Celsius Savings – 20%

- RPR – 15%

- Gold & Silver – 10%

Throughout the year take profits from BTC & ICLN and increase your positions in Celsius and RPR. Ultimately it will be hard to beat the 10% return Celsius promises and RPR is designed to be an all weather investment. We expect our more volatile assets to appreciate significantly this year however. Expect to hold the gold indefinitely.

Disclosures: I have included referral links for Robin Hood, Celsius, and Coinbase. I have small amounts invested in every asset mentioned in this article because I believe them all to be useful investments.

Investments are inherently risky, and each investment listed here comes with its own risks. This article is for entertainment purposes only and is not financial advice. The reader assumes all risk when it comes to their investments. You can read more on our disclosures page.

- Bitcoin’s Lightning Network Explained - July 24, 2023

- What is Signature Aggregation? - October 5, 2022

- How John Hwang Built Rainier Arms and His Diverse Personal Investment Portfolio - February 22, 2021