I believe Bitcoin is going to surge in 2021. We will see a Bull Run that peaks toward the end of 2021 or beginning of 2022. I recently wrote an article focusing on the reasons why bullish Bitcoin predictions may be wrong, but this is more of a Devil’s Advocate exercise on my own behalf.

I’m very bullish on Bitcoin and I’ll explain why. Other analysts mirror this sentiment, and history is on our side.

Bitcoin as a World Currency

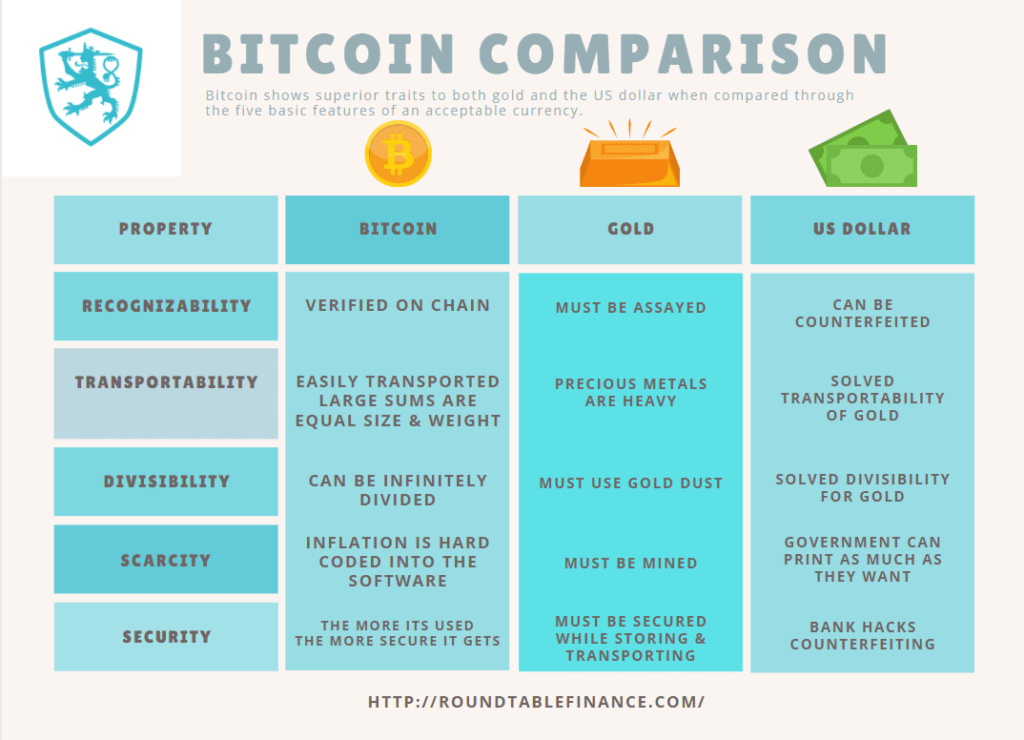

In my article A History of Money (coming soon) we took a deep dive into the way currencies have evolved over the years. Remember there are 5 traits that something needs to be used as a currency.

- Scarcity

- It must be easily recognized

- Can be divided

- Can substitute fractions for a whole

- Must be easily transported

Bitcoin was engineered to meet these criteria and in many ways it’s superior. Gold has traditionally been recognized as the most universally sound currency on earth, but it is difficult to transport in large sums, isn’t completely divisible (silver is often used in place of gold for small transactions) and the logistics of transporting gold brought about paper currency to use in its place.

Bitcoin was designed to use a proof of work model to confirm transactions. When you think about it gold is essentially a proof of work too, and like mining gold mining Bitcoin doesn’t always produce a reward.

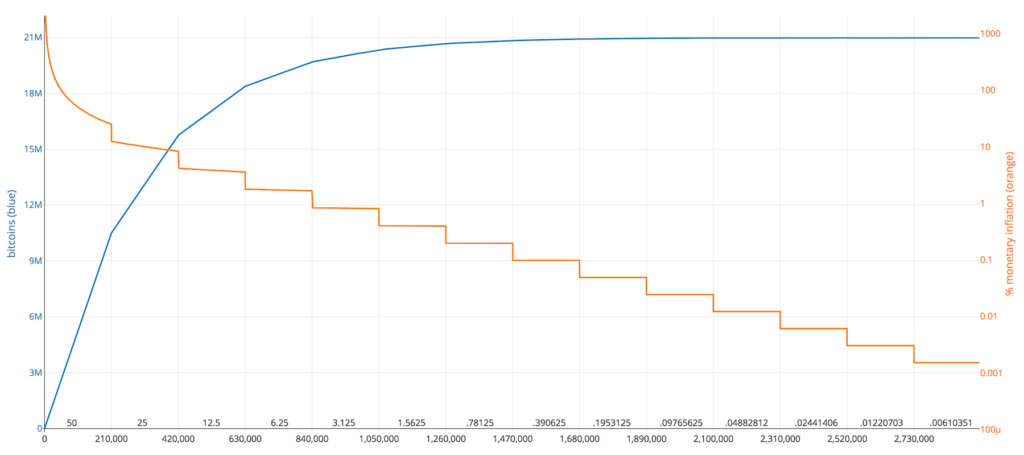

Bitcoin is a very simple piece of code that has spread to mining hardware all over the world. Every 4 years the Bitcoin that is received for mining 1 block on the chain is reduced by 50% which makes the future inflation of Bitcoin very transparent and predictable.

No government can control it and hackers have tried and failed for 12 years to exploit it.

Inflation Control

Bitcoin is designed so that every 4 years the payouts from mining are cut in half. The cycle of Bitcoin’s price growth and compression has closely followed the 4 year cycle so it’s safe to assume that these inflation controls are working at a basic level.

The fact that future inflation of Bitcoin is entirely predictable based on its code makes it especially attractive for users of all kinds. Gold’s scarcity and predictable inflation allowed it to become the de facto precious metal currency. Bitcoin has perfected these properties and improved on many other properties that other physical currencies never could.

Of course if physical realities stifle Bitcoin’s usage it can always be forked. Most analysts believe that Bitcoin has another 10 years or more before there’s even a small chance that economic practices could affect mining rates. Increasing prices provide incentive for the network to keep growing.

Bitcoin Settlement Assurances

Nic Carter wrote a piece in 2019 that suggested that the settlement assurances of Bitcoin transactions were one of its most important advantages.

Traditionally corporations and organizations that needed to send a large sum of money used SWIFT and wire transfers because they are nearly impossible to reverse. Thieves in the $1 billion 2016 Bangladesh bank robbery used SWIFT and bank wires for this reason. Even the banks could not reverse most of the transfers tied directly to the robbery.

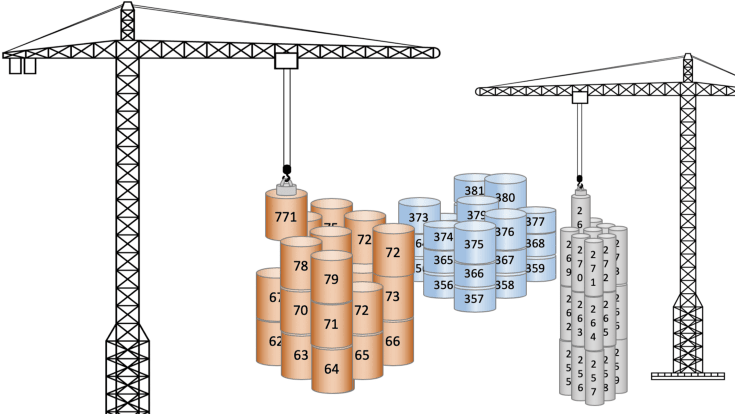

With Bitcoin the settlement assurance comes with the transactions that are posted after yours. To reverse a transaction you would need to reverse all of the subsequent transactions. Compared to other cryptocurrencies Bitcoin amasses settlement assurance exponentially faster.

A good rule of thumb is to only consider a transaction settled once the value paid to miners for transactions settled on top of it equal that transaction value. At that point it would cost more to reverse the transaction than the other party would receive for reversing it.

There Can Be Only One

Over the centuries the entire world chose gold as the most universally accepted currency. The primary reason that gold is preferred over silver is scarcity which gave it a more predictable inflation.

Gold’s inflation has remained consistent at <2% per year. When you are wanting to store wealth over time this becomes a very important aspect of currency.

For the most part gold has dominated world currency for centuries with silver and gold backed dollars being used to address its shortcomings. One precious metal had to be chosen over all others and gold’s intrinsic advantages made it an obvious choice the world over.

If one society used copper as currency and they began trading with another that had abundant copper mining operations then they would immediately find themselves at a trade deficit. Gold was the perfect choice to prevent this.

Bitcoin was developed in 2009 and there has been tremendous improvement in blockchain development and technology since then. There are cryptocurrencies that are seemingly faster and more secure on the surface. Banks can utilize their existing networks to launch powerful competitors at any time.

When you look into these claims and possibilities you’ll find that Bitcoin’s place at the top of the mountain just becomes stronger.

- Even if a new blockchain requires more confirmations it still isn’t more secure because Bitcoin’s security is tied directly to the number of miners and the investment they’ve made in hardware.

- Settlement assurances are many orders of magnitude greater.

- Even if a blockchain can confirm a transaction quicker or more cheaply it will still take much longer for settlement assurances to accumulate enough to finally settle a transaction.

- Banks would act as a trusted third party. The intrinsic security of blockchain technology is lost when it is centralized. A bank operated block chain is not much different than the electronic ledgers that are already used by banks in practice.

Network Effect

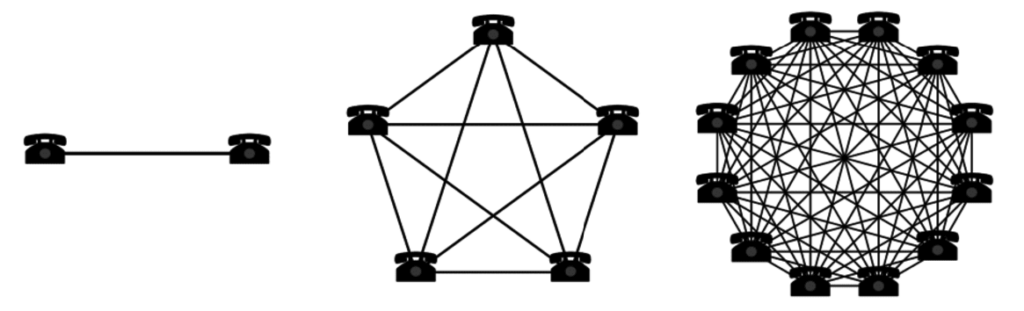

Bitcoin enjoys a network effect where the more people use it and mine it the more secure and resilient it becomes. At this point the adoption rate is so high that it is resilient to most of the concerns experts have traditionally held.

Facebook and other social platforms have used the network effect successfully to outperform competition. Since the utility of a network is proportional to the number of users large existing networks have a definite advantage.

Multi sided networks are even harder to disrupt because a competitor must provide incentives to all types of users. Networks can be viewed as polygons with each side representing a number of interests. For example Whatsapp had users, or 1 side. Ebay has buyers and sellers, 2 sides, each with an interest in the network. Facebook has increased their resiliency just by adding in groups and advertisers, which makes 3 sides. Bitcoin has buyers, sellers, miners, holders and a host of third parties.

When the number of buyers increase it directly benefits sellers which incentivizes more people to sell on Ebay. When the number of sellers increase it directly benefits buyers which incentivizes more people to use the marketplace.

For the network to be defeated there has to be incentive for each group of users to move to another network. For instance you could make a network to compete with Ebay that offered more money for sellers, but it in turn raises costs which makes it hard to incentivize buyers. Without both groups you cannot hack into the network effect Ebay has already created.

Bitcoin’s network is robust and proven. There have been several viable competitors enter the market with blockchains that had discernable advantages, but the utility of a cryptocurrency is entirely dependent on its network. So while it is easy to create a new cryptocurrency to compete with Bitcoin it has proven impossible to create one that is likely to overtake Bitcoin.

Why Governments Would Stop It

In 2021 many major governments rely on a monopoly on the creation of the domestic money supply to prop up their economies.

What this is actually allowing them to do is cover up bad decisions by printing more money.

Governments will not want to give up control of their domestic currencies, but it may not be long before world events will force their hand.

Why They Wouldn’t Be Able To

The good news is that Bitcoin is resilient to being affected by government restrictions and in its most basic form it cannot be controlled by any government.

It is nearly impossible to tell who is using Bitcoin and the mining rigs used to facilitate transactions are very small. Miners are located all over the world and as long as a single node is online it can replicate itself across the network.

You would have to take down every mining node at the same time forever to stop Bitcoin.

China has already tried cracking down on miners & exchanges.

By cracking down on Bitcoin exchanges it actually stopped selling while traders in other countries continued to buy and the price surged. Soon the Chinese miners had shipped their lightweight mining rigs to new locations and were back up and running because the government’s crackdown had increased incentive.

It’s Protected Under Your First Amendment Rights

In the 1990s the US government tried to convict Philip Zimmerman of exporting illegal munitions. Philip wasn’t exporting bombs or weapons, he was carrying a zip drive with simple cryptographic software he had developed called PGP (Pretty Good Privacy). The government claimed that it was a national security threat and there was a plethora of hearings and court cases in the following years.

In the end the Supreme Court found that since the software was nothing more than simple written words, much of it already in the public domain, that the software was protected as free speech under the first amendment.

Bitcoin is a very simple and elegant piece of code that has been publicly available for everyone to examine for the last decade. It is protected under the first amendment and it would take a court overturning an unprecedented amount of legal precedent to change that.

Any legislation that restricts a country’s population from participating in cryptocurrency is only preventing its citizens from enjoying the profit and benefits it brings with it. Exchanges are tax paying entities that will operate under some jurisdiction so it is prudent for governments to become Bitcoin friendly to attract those businesses.

Government Backed Bitcoin Competitors

One possible scenario is that world superpowers create competing cryptocurrencies backed by government. Many governments are looking into this already and its clear that switching to a digital currency could solve some of their problems with existing monetary policy while at the same time introducing a formidable competitor to Bitcoin.

Part of Bitcoin’s appeal is its features that completely conflict with modern monetary theory.

Part of the goal of Bitcoin was to give power back to the people and reverse the trend of expanding government. The more Bitcoin is substituted for fiat currency in a given country the smaller that government would become.

You would hold some bargaining power over the taxes you pay and they wouldn’t be able to just freeze your accounts or come out one day and say your money is worth less or more than you think it should be.

So while it’s possible that China or the US may introduce their own digital currency in the next decade it is unlikely that they would relinquish their power to mint new currency on a whim and without conceding power their new product will just be paper dollars in steampunk clothing. Even a digital US dollar that preserved the security, scarcity and decentralization would be decades behind Bitcoin in building a network and infrastructure.

The Biggest Threat: A Nation State Attack

In 2014 GHash.io’s Bitcoin mining operation passed the 51% hash rate mark for Bitcoin for a short time making the network susceptible to a 51% attack. When a single party controls 51% of the mining hash rate it opens up the network to manipulation such as double spend, slow transactions, and hacking.

Hackers immediately started DDOS attacks against GHash who pledged to limit their mining activities to 40% of the hash rate to keep the network secure.

Since that time no one has come close, although if you pooled the resources of the 5 largest mining pools you could potentially reach the 51% mark. As the network grows it becomes more secure, but there is a chance that a nation state such as China could confiscate all of the mining rigs in their country and invest considerable resources into destroying the network.

Of course this is unlikely. It would be far easier and more lucrative for China to invest early in Bitcoin and reap greater rewards from investment. It would be as far fetched and difficult as the US and Israel hacking Iran’s nuclear program and having their workstations play AC/DC Thunderstruck as their centrifuges self destructed.

The paradigm here is that as Bitcoin’s market cap grows the more attractive it becomes as a target, but the harder it is to compromise. Since all transactions are public security is crowdsourced with thousands looking over transaction logs each day. This has proved to be a superior security framework so far.

So while the threat is unlikely (hacking Bitcoin would be akin to hacking the entire Internet HTML protocol at once) it should be considered and hedged against. Most savvy investors will take profit along the way and diversify their holdings.

A simple way to invest in Bitcoin: If you think Bitcoin has a 5% chance of overtaking Gold as a long term store of value you should move 5% of your assets to Bitcoin. Then if you believe that there is a 10% chance of a nation state successfully attacking Bitcoin you should move 10% of those assets into an asset that would be unaffected by such an attack.

Bitcoin Price Cycle

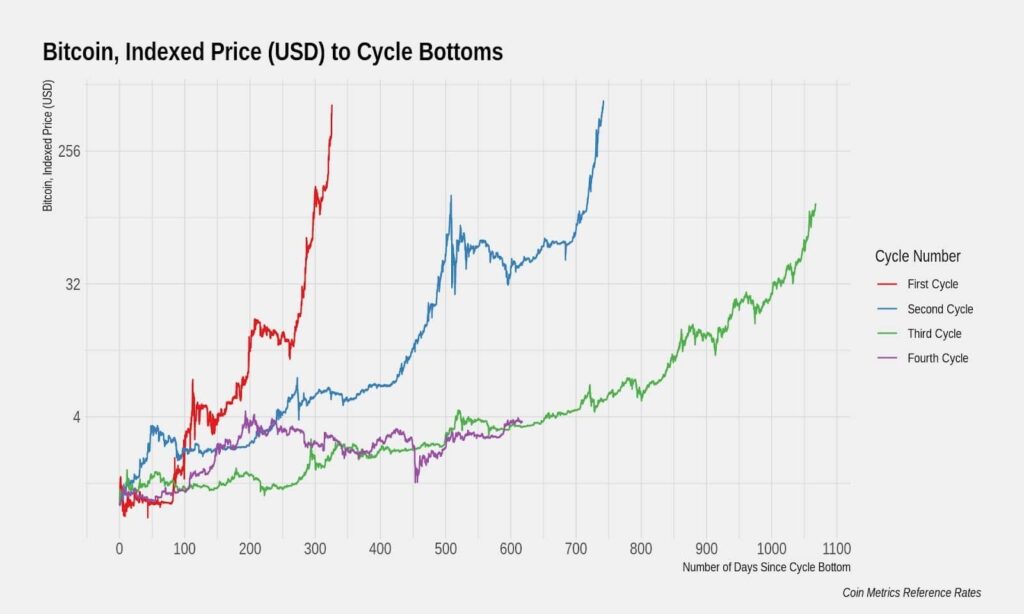

The 4 year halving cycle of Bitcoin has historically coincided with all time highs. Analyst Benjamin Cowen believes that Bitcoin does not follow a 4 year cycle, and I tend to agree.

History has shown that inflation control along with the increased market cap brings about lengthened cycles each time the mining reward is halved.

If anything 2020 has been the strongest year for Bitcoin yet. Besides seeing the dollar weaken because of COVID-19 Bitcoin has attracted a lot of institutional investment and a renewed interest in adoption.

After the next bull run we may see the smallest correction in history by percent. At this point we are so far into the cycle with Bitcoin continually gaining momentum that the 2021-2022 bull run is all but a foregone conclusion.

The only real question is how high will prices climb for Bitcoin in 2021 and how long will it last?

Bitcoin Price Predictions

Many analysts believe that the future of Bitcoin is binary; it will either replace the dollar or it will be worthless.

Personally I think that there is a number of roles that Bitcoin could have in the future, and the possibility of become a reserve currency used by nation states and large institutions is very likely as well.

Scenario one is that it continues to be a store of wealth for tech savvy professionals and is slowly adopted by new merchants as an acceptable form of Payment. In this case you could look to see Bitcoin prices grow to $40,000-$100,000 in the near future.

Scenario two is that Bitcoin is recognized as a suitable alternative to gold. This is becoming the most accepted scenario among investors. In this case you could see Bitcoin’s price surge to $200,000-$600,000.

The third scenario involves Bitcoin becoming accepted as a popular international currency whose utility rivals the US dollar. In this case the value of one Bitcoin would be over $1 million and as much as $3 million.

Of course there are scenarios that mix or split these possible outcomes. The most likely outcome I believe is that Bitcoin could replace SWIFT and bank wires, gold and US dollars as stores of wealth for sovereign states. I believe in my lifetime it will reach between $500,000-$1,000,000.

The first large corporations are already moving substantial assets to Bitcoin. Michael Saylor purchased $500 million worth of Bitcoin in 2020 and it’s already worth $1 Billion. It’s companies on the smaller end that have less red tape and stock holders to answer to. The same thing will happen when nation states start to move some of their wealth into cryptocurrency; dictatorships and smaller countries will be the first to react.

Modern Problems and Modern Solutions

Toward the end of the year Michael Saylor also did something that could lead to a rapid increase in Bitcoin investment. He offered a round of financing to investors with the sole intent of buying another $500 million in Bitcoin. The offering quickly oversubscribed. Why would someone invest in a company that planned to buy Bitcoin instead of just buying Bitcoin themselves?

As I’ve mentioned before on Round Table Finance many large funds and especially pension funds are strictly limited in what they can invest in. It would be pretty much impossible for the UAW to move part of their pension fund into Bitcoin. However, it’s not unlikely at all for a pension to invest in a high growth company with an attractive balance sheet. If Bitcoin happens to be a large part of that balance sheet, it’s still not perceived as being as risky as buying digital money.

Financial institutions are coming up with many clever routes to enjoy Bitcoin profits without actually buying and holding Bitcoin. There is a critical mass and volatility index that Bitcoin must reach before it can be a valid option for many financial institutions to invest in; so basically they are just waiting for the price to go up some more. If we reach the point that conventional institutional investment has Bitcoin as an option, the market could explode.

Volatility

Volatility is inversely related to market cap. If you look at Amazon during its early years the stock price had some pretty wild swings. As it has gotten bigger the volatility has slowed.

With Bitcoin you should realize that its industry is the world’s currency and there is currently $37 Trillion in circulation around the world. If you add up investments, derivatives and cryptocurrencies there is over $1.2 quadrillion. So Bitcoin’s $200 billion market cap is quite small, but it’s constantly growing.

As more investment banks and institutions move some of their capital to Bitcoin the volatility will slow.

Controlling Volatility Through Exposure

Imagine you started 2 investment portfolios 4 years ago. The first was composed of the S&P 500 and the second contained 99% US dollars and 1% Bitcoin. The second portfolio would have outperformed the first and the volatility would have been extremely low, much lower than the S&P 500.

This fact has led several institutions to start allocating small parts of their portfolios to Bitcoin and other cryptocurrencies. If volatility is too high for professional traders they simply minimize their exposure, and many more average people would benefit from the Bitcoin boom if they treated their investments the same way.

The Falling US Dollar

2020 was a record year for currency printers. The purchasing power of the US dollar has fallen by 20-30%. Our monetary policy has also made a situation where the dollar will continue to lose purchasing power for the next 5 years minimum at almost the same rate.

This means that if you make $1 million this year in 5 years it may only have the purchasing power than $300,000 currently does. You will see this most evident in scarce commodities and products with a high demand.

Moving your USD to Bitcoin is one way to protect your savings from become worthless. Of course it’s risky, but if you don’t do something you are guaranteed to lose a record amount of purchasing power over the next 5 years by hold dollars.

So What Should You Do Now?

If you believe Bitcoin is going to grow in value like we do then you should invest in Bitcoin right away.

- Bitcoin’s Lightning Network Explained - July 24, 2023

- What is Signature Aggregation? - October 5, 2022

- How John Hwang Built Rainier Arms and His Diverse Personal Investment Portfolio - February 22, 2021